Getting a mortgage can be stressful and confusing;

it doesn't have to be, let me show you how.

RABINDER DHILLON

MORTGAGE BROKER

Thank you for taking the time to visit my website. I look forward to working with you!

Since 2009, I have dedicated my career to helping people make informed decisions about their mortgage options. Taking on a mortgage is one of the largest financial commitments most individuals will make in their lifetime.

My goal is to ensure every client understands that I work for them—that their goals, concerns, and needs are all equally important. I strive to build long-term relationships based on trust, transparency, and understanding. My priority is to help clients fully explore their options so they can make confident, well-informed choices that support their long-term financial success.

I take pride in being a single point of contact for my clients, offering the personal attention and expertise they deserve throughout the entire mortgage process—and beyond. Mortgages can be complex and, at times, overwhelming. By liaising directly with lenders on my clients’ behalf, I ensure they are informed, comfortable, and never lost in lender jargon. With patience, persistence, and creative problem-solving, I work diligently to find solutions for even the most challenging files. There is always a path forward—sometimes a solution, sometimes a plan toward one.

One of the experiences I am most fond of was my time in the Alberni Valley promoting financial literacy among teens. From 2012 until the onset of COVID-19, I volunteered as a guest lecturer at ADSS, teaching students about the value of money—from saving and understanding credit to investing for the future. It was incredibly rewarding to see their curiosity grow and to know I was helping them build a foundation of financial confidence. I still believe that knowledge is power, and that the more young people understand about money, the stronger and more secure their futures can be.

Kind words from my clients

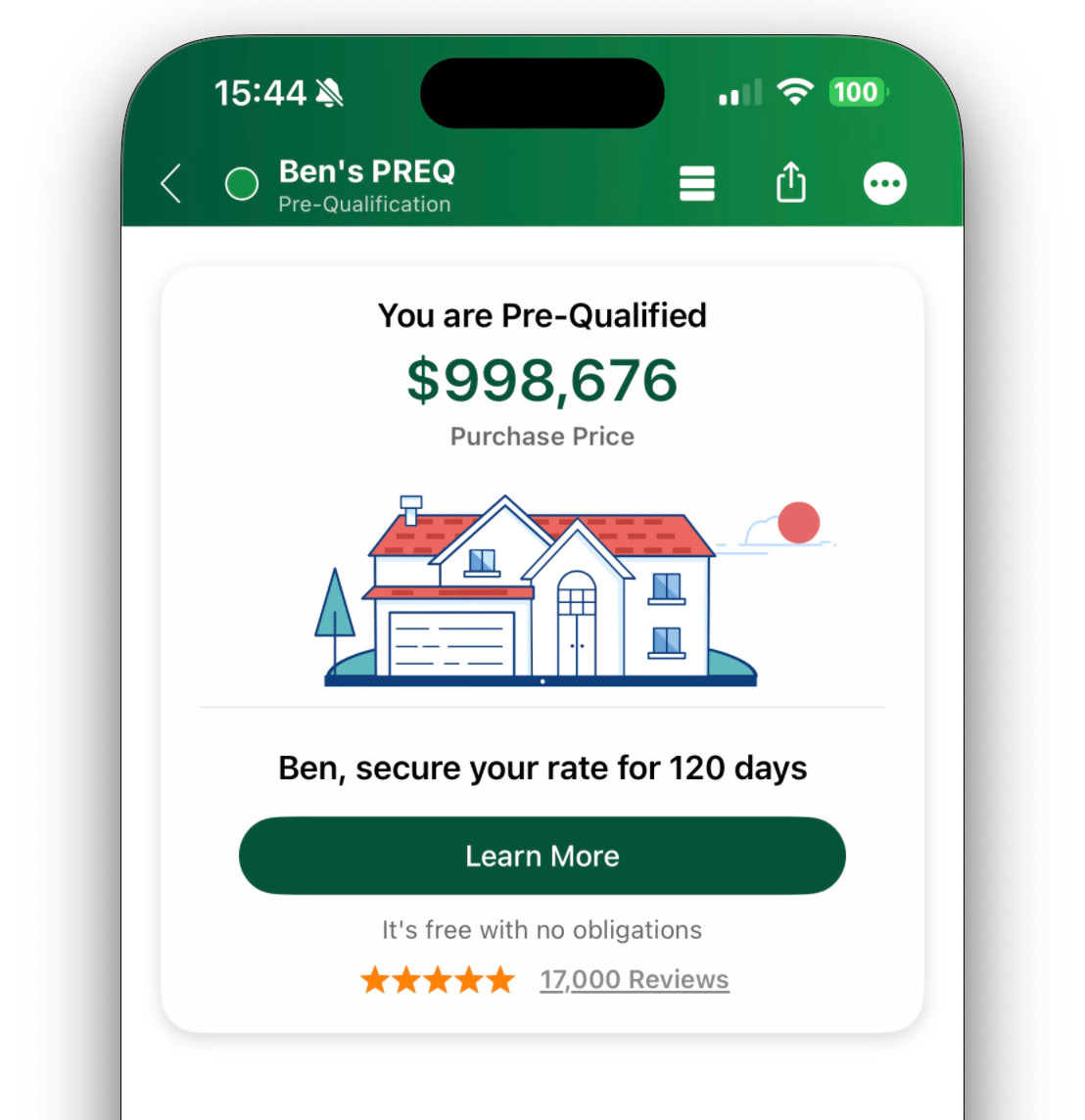

DOWNLOAD MY

FREE APP

Here's What You Can Do ⤵

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi, and Chinese

CALCULATE

Whether you're just getting started, have a home in mind, or want to refinance or renew an existing mortgage, why not start by using my online calculator?

APPLY NOW

I provide mortgage services to loyal clients in a transparent environment, with an authentic voice, helping them feel protected, and save time and money.

Mortgage Financing

Whatever your mortgage needs; I have the products you're looking for. Contact me anytime to find out more!

First Time Home Buyers

If you're looking to buy your first home, I've got the advice (and expertise) you're looking for. Let me guide you through the home buying process.

Going Through a Divorce?

I understand, sometimes life happens. If you're going through a divorce, or separation, there are programs that might allow you to keep the matrimonial home. Make sure to contact me for more information!

Experienced Home Buyers

If you're looking to climb the property ladder, refinance, or renew your existing mortgage, let me help you arrange financing so you can get the best mortgage for you!

Mortgage into Retirement

The power of working with me is that you get the care, attention, and knowledge of a professional Mortgage Broker.

Let's Run Some Numbers

VALUED RELATIONSHIPS

I've developed excellent relationships with Lenders, Realtors, Appraisers, Solicitors & Notaries, Home Inspectors, and many other service providers.

MORTGAGE RESOURCES